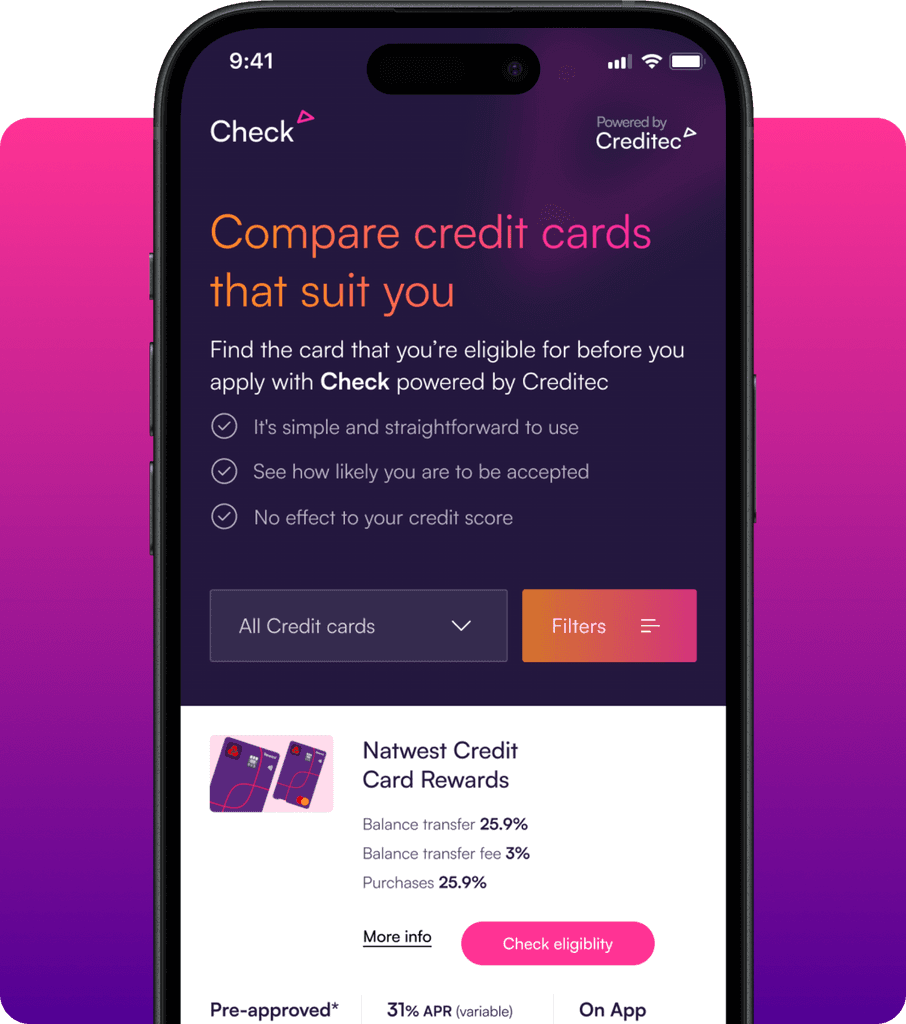

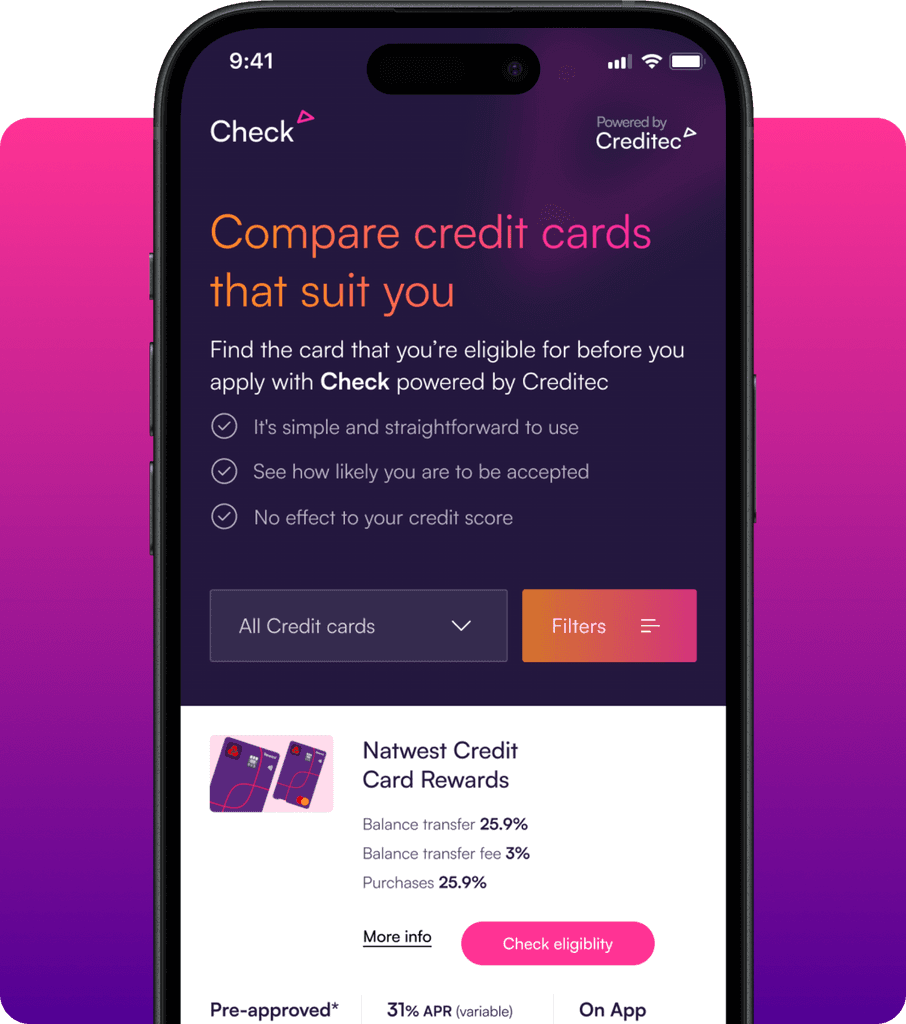

Marketplaces

Join our panel and unlock new distribution channels in line with your acquisition strategy

Creditec processes over 600k eligibility checks per month. Benefit from our decision engine to get in front of your target audience

Marketplaces

Join our panel and unlock new distribution channels in line with your acquisition strategy

Creditec processes over 600k eligibility checks per month. Benefit from our decision engine to get in front of your target audience

Trusted by the likes of

Why join the Creditec panel

Why join the Creditec panel

Whether you’re already in the industry or new to market. We can support your needs every step of the way.

Our solutions make it easier to go to market than anyone else

Whether you’re already in the industry or new to market. We can support your needs every step of the way. Our solutions make it easier to go to market than anyone else

Whether you’re already in the industry or new to market. We can support your needs every step of the way. Our solutions make it easier to go to market than anyone else

One API connection to unlock new distribution channels

Joining the panel opens up access to all current and future Creditec partners

Only decision on people who meet your credit risk profile

Creditec’s custom-built decision engine can host 1st line decisioning on your behalf

Remove friction and get to market faster than anyone else

Joining the Creditec panel couldn’t be simpler. No more waiting around

Access to near real-time dashboards to monitor your performance

No more guess work. Benefit from performance reports, trends against your competitors

One API connection to unlock new distribution channels

Joining the panel opens up access to all current and future Creditec partners

Only decision on people who meet your credit risk profile

Creditec’s custom-built decision engine can host 1st line decisioning on your behalf

Remove friction and get to market faster than anyone else

Joining the Creditec panel couldn’t be simpler. No more waiting around

Access to near real-time dashboards to monitor your performance

No more guess work. Benefit from performance reports, trends against your competitors

One API connection to unlock new distribution channels

Joining the panel opens up access to all current and future Creditec partners

Only decision on people who meet your credit risk profile

Creditec’s custom-built decision engine can host 1st line decisioning on your behalf

Remove friction and get to market faster than anyone else

Joining the Creditec panel couldn’t be simpler. No more waiting around

Access to near real-time dashboards to monitor your performance

No more guess work. Benefit from performance reports, trends against your competitors

What others say about us

Creditec is built on great relationships with our partners and providers

We’ve been impressed by the speed to get to market with Creditec. Their willingness and technical capability to pinpoint our target audience has been second to none!

Ian Sibbald

Executive Director | TransaveUK

Creditec have become a key strategic partner of Optimise over the past few years and we’re proud to be working with them. Their technology has helped deliver successful campaigns for their partners and we’re excited to see what more innovation they bring to the industry.

Leanne Hardy

Managing Director | Optimise

Creditec’s hybrid API solution allows us to provide a consistent and clear journey flow for our customers and we’re looking forward to working with the team at Creditec to continue enhancing the customer offering

Stephen Davis

Head of Performance | Finder

What others say about us

Creditec is built on great relationships with our partners and providers

We’ve been impressed by the speed to get to market with Creditec. Their willingness and technical capability to pinpoint our target audience has been second to none!

Ian Sibbald

Executive Director | TransaveUK

Creditec have become a key strategic partner of Optimise over the past few years and we’re proud to be working with them. Their technology has helped deliver successful campaigns for their partners and we’re excited to see what more innovation they bring to the industry.

Leanne Hardy

Managing Director | Optimise

Creditec’s hybrid API solution allows us to provide a consistent and clear journey flow for our customers and we’re looking forward to working with the team at Creditec to continue enhancing the customer offering

Stephen Davis

Head of Performance | Finder

What others say about us

Creditec is built on great relationships with our partners and providers

We’ve been impressed by the speed to get to market with Creditec. Their willingness and technical capability to pinpoint our target audience has been second to none!

Ian Sibbald

Executive Director | TransaveUK

Creditec have become a key strategic partner of Optimise over the past few years and we’re proud to be working with them. Their technology has helped deliver successful campaigns for their partners and we’re excited to see what more innovation they bring to the industry.

Leanne Hardy

Managing Director | Optimise

Creditec’s hybrid API solution allows us to provide a consistent and clear journey flow for our customers and we’re looking forward to working with the team at Creditec to continue enhancing the customer offering

Stephen Davis

Head of Performance | Finder

Helping protect those most vulnerable through innovation and technology

Creditec’s Vulnerability Detection analyses behavioural, application and bureau data in real-time to identify signs of vulnerability and tailors the service.

Credit unions and community banks can play a crucial role in protecting vulnerable customers from turning to high-cost short term lending. Get in touch today and join our mission to protect vulnerable customers

Helping protect those most vulnerable through innovation and technology

Creditec’s Vulnerability Detection analyses behavioural, application and bureau data in real-time to identify signs of vulnerability and tailors the service.

Credit unions and community banks can play a crucial role in protecting vulnerable customers from turning to high-cost short term lending. Get in touch today and join our mission to protect vulnerable customers

Helping protect those most vulnerable through innovation and technology

Creditec’s Vulnerability Detection analyses behavioural, application and bureau data in real-time to identify signs of vulnerability and tailors the service.

Credit unions and community banks can play a crucial role in protecting vulnerable customers from turning to high-cost short term lending. Get in touch today and join our mission to protect vulnerable customers

Book a demo today

See how Creditec could support you in bringing marketplaces to your customers.

Creditec Limited is acting as a credit broker, not a lender, we are authorised and regulated by the Financial Conduct Authority (FRN: 971164).

Creditec Limited is registered in England and Wales under company number 13700425; registered office: The Steam Mill Business Centre, Steam Mill Street, Chester, United Kingdom, CH3 5AN. ICO registration number: ZB288703

Book a demo today

See how Creditec could support you in bringing marketplaces to your customers.

Creditec Limited is acting as a credit broker, not a lender, we are authorised and regulated by the Financial Conduct Authority (FRN: 971164).

Creditec Limited is registered in England and Wales under company number 13700425; registered office: The Steam Mill Business Centre, Steam Mill Street, Chester, United Kingdom, CH3 5AN. ICO registration number: ZB288703

Book a demo today

See how Creditec could support you in bringing marketplaces to your customers.

Creditec Limited is acting as a credit broker, not a lender, we are authorised and regulated by the Financial Conduct Authority (FRN: 971164).

Creditec Limited is registered in England and Wales under company number 13700425; registered office: The Steam Mill Business Centre, Steam Mill Street, Chester, United Kingdom, CH3 5AN. ICO registration number: ZB288703